How asset managers can engage institutional and adviser audiences in a saturated digital landscape.

In today’s financial services ecosystem, asset managers face a critical challenge: how to meaningfully connect with institutional investors and advisers when traditional digital channels have become oversaturated with content. The online environment is now densely packed with competing messages, making conventional outreach tactics significantly less effective as digital placements hit diminishing returns.

Yet within this challenge lies unprecedented opportunity. By leveraging advanced data science, behavioral insights, and precision-targeted communication, forward-thinking asset managers can achieve superior engagement with dramatically reduced waste. The path forward requires abandoning volume-based approaches in favor of intelligence-driven strategies that deliver the right message to the right audience at precisely the right moment.

The Saturation Crisis

LinkedIn, once the premier channel for B2B financial services marketing, has reached a critical saturation tipping point. The platform now processes an overwhelming volume of content – with members engaging with 1.5 million pieces every minute and 2 million new posts, articles, and videos created daily (LinkedIn, 2024). This explosion in content supply has been fueled by widespread adoption among B2B marketers: 85% now prioritize LinkedIn advertising (Demandbase, 2024), while 68% increased their platform usage throughout 2024 (Content Marketing Institute, 2024).

The mathematical reality is stark, when nearly nine out of ten B2B marketers are competing for attention on the same platform, and two-thirds are simultaneously ramping up their activity, the inevitable result is a fragmented audience and diluted message impact. Across the 47,735 LinkedIn pages and 577,180 posts on LinkedIn that were analyzed in the 2025 study by Metricool, the data shows that financial industry accounts post on average three times per week. This saturation translates into diminishing returns on content investments, as valuable prospects become increasingly selective about which messages merit their attention in an environment of information abundance.

Financial services firms are experiencing precipitous declines in organic engagement, with multiple industry reports indicating significant drops in meaningful interactions despite exponentially increased content production. This decline stems from multiple converging factors: “content shock” as audiences become overwhelmed by information volume, the commoditization of financial content as every firm shares similar insights, and the evolution of digital-native decision-makers who demand more sophisticated, personalized experiences.

The trend is unmistakable. The result is information fatigue, skyrocketing customer acquisition costs, and diminishing returns on marketing investments that once delivered consistent results.

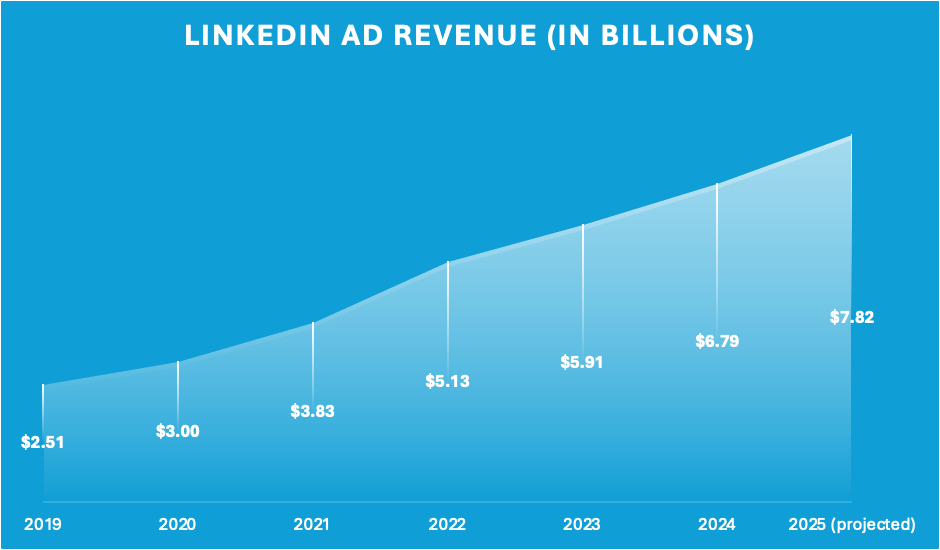

Source: Statista

Moving Beyond Conventional Channels

The solution transcends channel selection – it requires fundamental transformation of how, when, and to whom messages are delivered. Success in this environment demands strategic sophistication that treats audience attention as the precious, finite resource it has become.

Precision Intelligence

Progressive asset managers are moving beyond rudimentary segmentation based on job titles or AUM to create sophisticated audience intelligence that layers multiple data sources: firmographics, digital consumption patterns, historical engagement behavior, and psychographic indicators. This multidimensional approach enables content delivery that aligns with prospects’ current decision-making context, not merely their organizational role.

Adaptive Messaging Architecture

One-size-fits-all messaging is marketing malpractice in today’s environment. A quantitative fund portfolio manager in Singapore operates within entirely different constraints and priorities than a wealth adviser in Manchester. Leading firms now deploy dynamic creative optimization that tailors messaging, imagery, and content format in real-time based on behavioral signals and contextual data.

Intelligent Channel Orchestration

LinkedIn remains valuable but insufficient as a standalone solution. Sophisticated engagement strategies now orchestrate complementary touchpoints across programmatic advertising, niche adviser networks, premium newsletters, and targeted podcast placements. This multi-channel approach allows firms to reach the same decision-makers in lower-noise environments, often achieving superior cost-per-qualified-engagement ratios.

Micro-Community Development

Rather than broadcasting to broad audiences, successful firms are cultivating exclusive micro-communities centered around specific investment themes or institutional challenges. These curated environments foster deeper relationships with smaller, strategically valuable audiences who genuinely value specialized expertise and insights.

Interactive Decision Support Tools

Static content is rapidly giving way to interactive experiences that provide genuine utility. Portfolio construction tools, scenario modeling applications, risk assessment calculators, and customizable allocation frameworks create meaningful engagement while capturing valuable preference and priority data that informs future interactions.

The Science of Strategic Engagement

The fundamental insight driving this transformation: success requires better models, not bigger budgets. Traditional media approaches function as blunt instruments in an environment demanding surgical precision. With sophisticated technology stacks and analytical frameworks, financial marketers can:

- Eliminate media waste by excluding saturated or irrelevant audience segments

- Amplify qualified engagement through intent-driven targeting methodologies

- Accelerate pipeline velocity by synchronizing messaging with buyer readiness signals

The most sophisticated asset managers now apply behavioral economics principles to understand precisely how and when institutional decision-makers are most receptive to new information. By mapping the cognitive biases, decision heuristics, and information processing patterns used by different institutional investor types, firms can optimize both timing and framing for maximum cognitive impact.

Advanced predictive models now forecast when specific institutions are entering research phases for particular asset classes, enabling precisely calibrated outreach during peak receptivity windows. Organizations implementing these sophisticated approaches report substantial engagement rate improvements while simultaneously reducing overall content production volume by focusing efforts on high-probability opportunities.

Achieving Superior Outcomes Through Strategic Focus

The central paradox of modern financial marketing is that exceptional results often emerge from producing less content with greater precision and relevance. Asset managers succeeding in this environment consistently focus on:

- Creating fewer, higher-impact thought leadership pieces that address specific institutional pain points

- Delivering personalized insights aligned with critical decision moments

- Building integrated engagement ecosystems rather than isolated campaign activities

- Measuring success through allocation influence and relationship depth rather than vanity metrics

Implementation Roadmap

For asset managers committed to evolving their engagement approach:

1. Audit your existing digital footprint to identify content saturation and effectiveness gaps

Conduct a comprehensive review of your LinkedIn content performance over the past 12 months, focusing on which posts generated genuine business inquiries versus superficial engagement. Analyze where your competitors are concentrating their efforts and identify underserved conversation areas where your expertise can provide unique value. Use LinkedIn’s search functionality to understand what your target audience is actually discussing and what challenges they’re sharing organically.

2. Invest in behavioral data capabilities that go beyond traditional engagement metrics

Implement UTM tracking for all LinkedIn-driven website traffic and establish lead scoring systems that assign values to different interaction types based on their correlation to business outcomes. Deploy social listening tools to monitor mentions of your firm and relevant industry keywords, creating opportunities for timely, contextual engagement. Build cross-platform attribution models that connect LinkedIn interactions to other touchpoints in your sales funnel.

3. Develop micro-targeting frameworks based on institutional decision calendars

Research your target institutions’ fiscal years, board meeting schedules, and historical RFP patterns to time content when decision-makers are most receptive. Create detailed personas that account for decision-making authority and internal influence networks, recognizing that a university endowment CIO operates differently than a corporate pension CIO. Map the complete decision-making unit for each target institution to ensure your engagement strategy nurtures relationships across the entire network.

4. Create value-driven tools and resources that generate proprietary engagement data

Develop interactive content like portfolio construction tools or risk calculators that provide immediate value while capturing data about prospects’ priorities and challenges. Host LinkedIn Live sessions that encourage real-time interaction and demonstrate expertise through problem-solving rather than presentations. Create content series that require ongoing engagement, building habit-forming interaction patterns that increase your share of mind during critical decision periods.

5. Shift measurement toward quality over quantity metrics

Establish KPIs that directly correlate with business objectives, such as “LinkedIn-sourced meetings with qualified prospects” and “LinkedIn-influenced pipeline value” rather than follower counts or impressions. Implement relationship scoring that measures engagement depth and consistency with high-value prospects over time. Create feedback loops connecting LinkedIn activities to closed deals, identifying which touchpoints contributed to successful relationship development and optimizing your approach based on proven success patterns.

The Future of Institutional Engagement

Institutional and adviser audiences have fundamentally evolved their expectations and information consumption patterns. Asset managers operating with outdated strategies are spending exponentially more to achieve diminishing visibility and influence.

The most successful asset managers won’t be those amplifying their voice across crowded channels. Instead, they’ll be the firms that deliver precisely calibrated insights to carefully selected audiences at strategically optimal moments, supported by sophisticated data science and deep behavioral understanding.

By embracing this intelligence-driven approach to engagement, asset managers can transcend digital noise, cultivate meaningful institutional relationships, and achieve superior business outcomes with unprecedented efficiency.

The winning playbook requires:

- Abandoning one size fits all methodologies in favor of precision targeting

- Harnessing predictive analytics and creative agility

- Meeting audiences where they are cognitively, not just digitally

The future of institutional engagement isn’t about increasing volume.

It’s about amplifying intelligence.